PayPal committed to fund up to $25 million of interest-free cash advances to help federal government employees during the shutdown. PayPal is offering an interest-free cash advance up to $500 for federal employees through its PayPal Credit platform to pay for food, gas, and other everyday necessities.

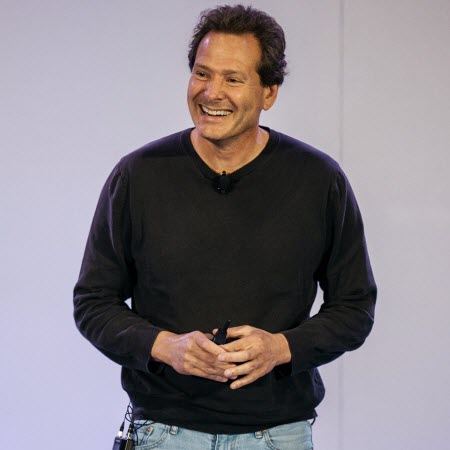

In a blog post today, PayPal CEO Dan Schulman said, “No matter where you stand on the issues, the fact is that 800,000 of our fellow Americans suddenly find themselves without a paycheck. With the average government employee taking home roughly $500 a week, many people were already struggling before the shutdown. There are bills to be paid, groceries and gas to be bought, families to support. These needs grow more urgent with each passing day.”

Schulman said the program was initiated with the help of PayPal partner Synchrony.

EcommerceBytes recently tweeted that federal workers impacted by the government shutdown should call their bank, credit card providers, lenders, etc., as they have been offering assistance to lenders, and we pointed to the FDIC notice urging financial institutions to work with customers affected by the federal government shutdown, which offered the following highlights:

- Borrowers affected by the government shutdown are encouraged to contact their lenders immediately should financial strain occur.

- The FDIC encourages financial institutions to consider prudent workout arrangements that increase the potential for creditworthy borrowers to meet their obligations.

- The FDIC recognizes that prudent workout arrangements that are consistent with safe-and-sound lending practices are generally in the long-term best interest of the financial institution, the borrower, and the economy.

- When consistent with safe-and-sound banking practices, these efforts may include extending new credit, waiving fees, easing credit card limits, allowing customers to defer or skip payments, modify terms on existing loans, and delaying the submission of delinquency notices to credit bureaus.

- Prudent efforts to meet such customers’ financial needs should not be subject to examiner criticism.

Readers should take note that events like the shutdown offer opportunities to fraudsters. Whether you are a worker impacted by the shutdown or someone who is trying to help, watch out for spoofs and cons.

PayPal’s Dan Schulman pointed to 211.org for more information for workers impacted by the government shutdown.

Update 1/18/19 : We asked about contractors impacted by the shutdown – a PayPal spokesperson responded, “At this time the program is open to U.S. federal government employees with a PayPal and PayPal Credit account in good standing.”

Gesh good for paypal BUT whats the big deal. No one ever helped the auto workers when they got laid off, or the truckers. This is life. Government workers are no better than anyone else least they think that they are entited. People get laid off and are on strike all over the country at various times and they don’t whine as much as these workers have.

Government is typically considered a stable job so they have a lower risk profile for borrowing. Don’t let that ruin your rant against working Americans that may have chosen public service because the holy corporations shipped jobs out and imported guest workers.

DON’T TAKE THE BAIT ! ! !

PayPal will have to steal from another seller to replace the cash. PayPal is always being investigated by the FBI and USDOJ so wil the crooks get special treatment now? Schumann clean up your act.